Unlocking the Power of BUSINESS CREDIT BUILDER

Building a strong financial foundation is crucial for any business looking to grow and thrive in today’s competitive market. One essential tool that can help businesses establish and strengthen their financial standing is the Business Credit Builder. This innovative program offers a range of benefits and services designed to support businesses in creating a solid credit profile that can open doors to various opportunities.

The Benefits of Business Credit Builder

Business Credit Builder accounts play a vital role in the financial health of a business. By establishing and maintaining a positive credit history, businesses can access higher credit limits, better loan terms, and favorable interest rates. Here are some key benefits of utilizing a business credit builder program:

- Improved Financial Health: Building a strong credit profile can enhance a business’s credibility and reliability in the eyes of lenders and suppliers.

- Access to Capital: With a solid credit standing, businesses can qualify for higher loan amounts and better financing options.

- Growth Opportunities: Establishing good business credit opens up opportunities for expansion, partnerships, and investments.

- Risk Mitigation: Separate business credit helps protect personal assets and reduces the risks associated with business debt.

- Vendor Relationships: Strong credit can lead to better terms with vendors and suppliers, enhancing cash flow management.

Understanding Business Credit Builder

A Business Credit Builder card works similarly to a personal credit card but is specifically designed for business expenses. This type of card helps businesses separate personal and business finances, track expenses, and build a credit history for the business entity. By using a business credit builder card responsibly, businesses can demonstrate their creditworthiness and improve their credit scores over time.

Moreover, Business Credit Builder loans offer businesses access to capital while simultaneously helping them establish a positive credit history. These loans typically have flexible terms and repayment options, making them suitable for businesses at various stages of growth.

Frequently Asked Questions

- What are Business Credit Builder Tradelines?

Business Credit Builder tradelines are accounts or lines of credit that businesses can establish to build their credit profiles. These tradelines report business credit activity to major credit bureaus, helping businesses improve their credit scores. - How do Business Credit Building Services work?

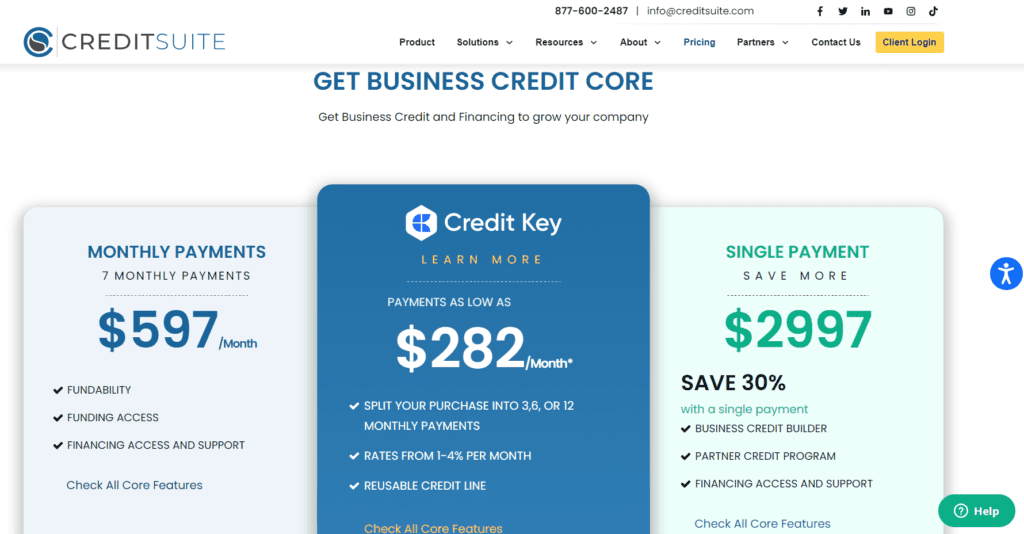

Business Credit Building Services assist businesses in navigating the process of establishing and improving their credit profiles. These services offer guidance on building credit, accessing financing, and maintaining a strong financial foundation. - Are there reputable BUSINESS CREDIT BUILDER Companies?

Yes, there are several reputable business credit builder companies that specialize in helping businesses build and strengthen their credit profiles. These companies offer tailored solutions to meet the unique needs of different businesses. - Can Business Credit Builders improve a business’s credit score?

Absolutely. By utilizing Business Credit Builder programs and services, businesses can enhance their credit scores over time through responsible credit management and timely payments. - What do business credit builders reviews say?

Business Credit Builders reviews provide valuable insights into the experiences of other businesses that have utilized these services. Reading reviews can help businesses select the right Business Credit Builder program for their needs.

In Conclusion

Business Credit Builder programs offer businesses a strategic way to establish and improve their credit profiles, paving the way for financial stability and growth. By leveraging the benefits of Business Credit Builder accounts, cards, and loans, businesses can position themselves for success in the competitive business landscape. With the support of reputable business credit builder companies and services, businesses can navigate the complexities of credit building with confidence and efficiency.